How Commercial Real Estate Portfolio Management Software Can Help Streamline Your Investment

Real Estate Portfolio Management Software Help to Investment

If you don’t have the necessary skills and resources, investing in commercial real estate may be time-consuming even if it might be a rewarding prospect. It may also easily become burdensome to update and maintain spreadsheets containing a lot of information on rental income, costs, and profitability. However, all data is kept in one location with a portfolio management software, which simplifies the laborious process of maintaining records and provides you with quick access to trustworthy data.

The Advantages of Software for Commercial Real Estate Portfolio Management

Software for managing your commercial real estate portfolio can help you manage your investments more easily by providing a number of advantages. It makes it easy for you to concentrate on your properties and increase your revenues by offering a straightforward, user-friendly platform for managing and comprehending your portfolios. The following are some of the main characteristics of software for managing commercial real estate portfolios and the advantages of utilising it:

– Automated financial tracking – With automated financial tracking, you can be more organized and efficient. All of your financial data is easily accessible from your portfolio management software, making it much easier to create accurate financial reports and analyze your investments.

– Advanced Analytics – Commercial real estate portfolio management software provides you with detailed analytics on your current investment portfolios, as well as how your investments have performed in the past. You’ll have easy access to insights, reports, and data, allowing you to make more informed decisions about where to allocate your money.

– Better communication – Keeping track of all your tenants’ contact information, rental payments, and issues can be difficult, especially when you’re dealing with multiple properties at once. With a portfolio management platform, all of your tenant data is stored in one place, making it easier to keep track of communication with tenants, manage their rental payments, and address any issues that arise.

– Time management – With automated processes and a streamlined workflow, tracking your rental properties’ performance and profitability becomes much easier. You’ll be able to manage your portfolios more efficiently, which can save you a lot of time and energy.

The Key Features of Commercial Real Estate Portfolio Management Software

Commercial real estate portfolio management software comes with a variety of features and functionalities geared towards streamlining the process of managing your portfolios. Here are some of the key features of these platforms, all of which help make managing your investments much easier:

– Real-time reporting – Real-time reporting makes it possible to track and monitor the performance of your portfolios in real time. This makes it much easier to identify potential problems and opportunities with your investments, enabling you to make more informed decisions.

– Data integration – Many portfolio management platforms provide the option to integrate data from other sources, such as financial services, mortgages, and rental agreements. This allows you to access all of your data in one place without having to manually input all the information yourself.

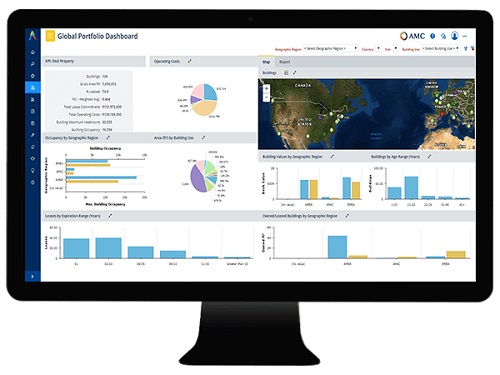

– Customizable Dashboards – Dashboards help you get a better overview of your portfolios and make it easier to monitor and analyze your investments. Look for portfolio management platforms with customizable dashboards, which allow you to choose what metrics and data you want to see displayed.

– Easy scalability – If your portfolios grow, you’ll need a portfolio management platform that can easily handle your additional investments. Look for a solution that allows you to scale up your portfolios as needed, so you can keep track of all your properties without having to switch to another platform.

Finding the Right Commercial Real Estate Portfolio Management Software

Not all portfolio management software solutions are the same. To find the best platform for your needs, it is important to compare features, pricing, and customer support. You should also consider the scalability of the platform, as well as how user-friendly the interface is. Additionally, make sure the platform is compatible with your other systems, such as financial services and mortgage providers. Finally, look for a platform with reliable customer support, so you know you’ll have help when you need it.

In summary

Software for managing a commercial real estate portfolio is an effective tool for investment management. It offers a solitary, user-friendly platform for monitoring rental revenue, costs, and profitability. Making smarter judgements and analysing portfolios is made simpler by automation and advanced analytics. The technology also facilitates easier tenant contact and improves portfolio management. Take features, cost, scalability, and customer service into consideration when choosing the finest portfolio management platform for your requirements.